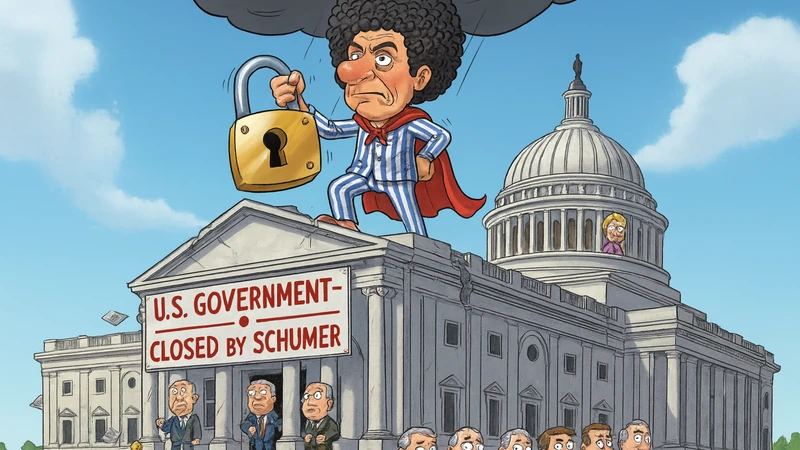

Let’s start with the obvious — when a shutdown gets a nickname, someone’s losing the messaging war. And this one’s being called the “Schumer Shutdown” for a reason. The public narrative has tilted sharply against Democrats, and even their most reliable institutional allies are turning up the heat. When the largest federal union in America — the American Federation of Government Employees (AFGE) — publicly blames Democrats for holding the government hostage, that’s not just a headline. That’s a fracture in the Democratic coalition.

Now combine that with the SNAP program sitting in jeopardy and you start to see real political consequences. Democrats are trying to tie additional spending demands to a “clean” Continuing Resolution, and that gamble could backfire spectacularly. If SNAP funding dries up and working-class families feel the squeeze, the optics will be brutal — especially since this group forms a large part of the Democrats’ traditional base.

For Republican investors, this isn’t just political theater. It’s a signal. Here’s why:

1. Market Volatility Meets Political Weakness

Markets love predictability — and Washington isn’t providing any. With federal paychecks paused, consumer confidence dipping, and essential programs like SNAP hanging by a thread, investors should expect short-term volatility, particularly in consumer staples and retail.

But the long-term takeaway is where opportunity lives: the political blame is consolidating against Democrats. That shifts the odds toward a more conservative fiscal environment — less spending, fewer regulatory pushes, and a return to pro-growth pragmatism.

Translation: Investors aligned with Republican policy positions could find themselves on the right side of the next market cycle.

2. When Unions Turn, the Economic Story Changes

The AFGE’s move isn’t just symbolic — it represents a breach in a decades-long partnership between public-sector unions and Democratic leadership. When your own base starts saying, “You’re hurting us,” the moral high ground collapses.

For markets, this signals a potential thaw in anti-business sentiment from organized labor. If the Democratic Party weakens its grip on union solidarity, it gives more breathing room for bipartisan industrial and infrastructure deals — especially those that benefit domestic production, energy, and defense contractors.

That’s bullish territory for Republican investors positioned in hard assets and U.S. manufacturing.

3. SNAP and the Optics of Economic Mismanagement

The Supplemental Nutrition Assistance Program (SNAP) is politically delicate. If it gets tangled in this shutdown, millions of lower-income families will feel it immediately. Historically, that’s when the middle electorate tunes in — and not kindly.

Democrats arguing for expanded spending in the middle of a shutdown will look tone-deaf to both moderate voters and markets. The likely result? A political retreat toward fiscal restraint once the dust settles.

Investors who align portfolios with Republican-led budget stability — defense, energy, infrastructure, and manufacturing — could see a positioning advantage as markets price in a shift away from progressive spending proposals.

4. Policy Momentum Shifts Toward the Right

If Democrats take the bulk of the blame — and the early polling, union pressure, and media tone all suggest they will — expect the White House to recalibrate. When the political class feels pain, they reach for the familiar: pro-growth, low-tax, investor-friendly messaging.

That’s the moment Republican investors should be ready for.

Once the shutdown breaks, there’s a window where legislation aimed at stabilization, industrial productivity, and energy expansion could move quickly — especially if it carries bipartisan cover.

5. Short-Term Pain, Long-Term Opportunity

Yes, volatility will spike as government services pause and political rhetoric heats up. But the underlying fundamentals — inflation cooling, rates stabilizing, and a business community desperate for predictability — favor investors who can see beyond the noise.

The Schumer Shutdown may look messy today, but for investors with a Republican mindset — who understand that political overreach always corrects itself — this could mark the start of a more disciplined fiscal cycle.