Patriots, the scoreboard just lit up. The U.S. economy posted 3.8% GDP growth in Q2, the strongest number we’ve seen in recent quarters. This is not spin, not wishful thinking—it’s real proof that America is moving forward, faster and stronger than the critics expected. For Republican investors, the message is clear: we are in a winning cycle, and positioning matters.

The GDP Scoreboard

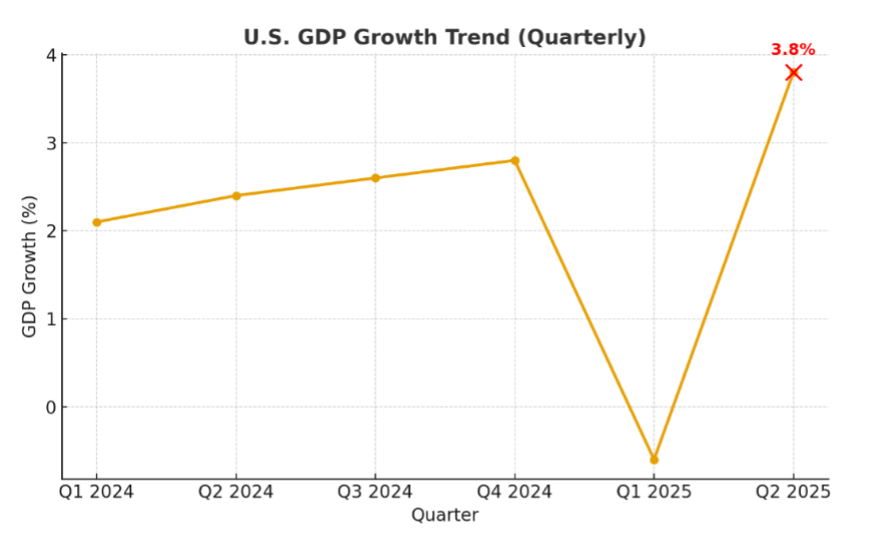

Here’s the trend line that tells the story—America dipped early in 2025 but roared back with authority:

The latest 3.8% print is highlighted in red, a reminder that the economy isn’t just stabilizing—it’s accelerating.

Why 3.8% Is More Than Just a Number

Three-point-eight percent is not a soft gain—it’s surging growth. At this pace, America is doing what most developed nations can’t: expanding with confidence. It’s the difference between muddling along and charging ahead.

And this didn’t happen by accident. The number reflects real consumer demand, strong private investment, and America’s unmatched energy engine. Even with global headwinds, our economy is proving resilient and dominant.

Breaking Down the Drivers

- Consumers Steady and Strong: Households are not folding. Spending remains healthy, especially in services and durable goods. This tells us Americans see stability ahead and are willing to put their money into the market.

- Manufacturing Muscle: After years of outsourcing, production is shifting home. Reshoring isn’t a buzzword anymore—it’s visible in the GDP data. Factories are building, jobs are being created, and domestic supply chains are taking shape.

- Energy Independence in Action: Oil, gas, and even renewables are driving momentum. America is exporting strength, not begging for it. Energy leadership directly feeds into growth, national security, and market confidence.

- Investment Confidence: Businesses aren’t sitting on their hands. Capital is flowing into expansion, technology, and infrastructure. That’s the ultimate sign that growth is expected to continue.

Where Republican Investors Should Focus

- Small-Caps & Industrials: These are the companies tied directly to American growth. They benefit first and strongest when the economy accelerates.

- Energy & Infrastructure: Pipelines, shipping, construction, logistics—growth demands all of it. This sector is the backbone of a 3.8% GDP environment.

- America First Alternatives: Private equity, farmland, hard assets—these give investors direct ties to the real economy, not the paper promises of globalist markets.

- Financials: Banks and lending institutions benefit when growth increases demand for credit. Republican investors should watch regional banks and fintechs built on America-first markets.

The Political Edge of Growth

Numbers like 3.8% don’t just move markets—they move politics. Republicans can now point to proof that lower taxes, deregulation, energy independence, and border security deliver results. This economy gives the GOP the high ground heading into 2026.

It also undercuts the narrative of decline. America isn’t weak, fragile, or dependent. America is winning—and Republican investors are positioned to benefit from that strength.

The Winning Mindset

This isn’t the time to retreat. It’s the time to lean in. A 3.8% GDP print is the market telling you that momentum is on your side. Don’t think in terms of defense—think in terms of offense.

Winning compounds. Winning builds confidence. Winning attracts capital. And today, the scoreboard says America is winning.

Patriots, the takeaway is simple: The economy works when America is free, strong, and confident. The free market is not just surviving—it’s thriving. And Republican investors who plant their flag here will not just preserve wealth, but grow it in the season of victory.