“Some of the best gifts sit quietly under the tree — forgotten sectors waiting to shine.” – Santa

___________________________________________________________________________________

Ho ho ho, my fiscally prudent friends! Santa here with a sack full of investment insights for those who like their portfolios like their Christmas trees: stable, well‑lit, and standing strong on American-made foundations.

This year’s holiday mood is cheerful but cautious, the kind where families still shop — but do it sensibly, the way Mrs. Claus shops for cookies on sale. And while consumers behave like responsible elves, Santa has spotted a few “hidden gifts” in the market that conservative investors should keep their mittens on.

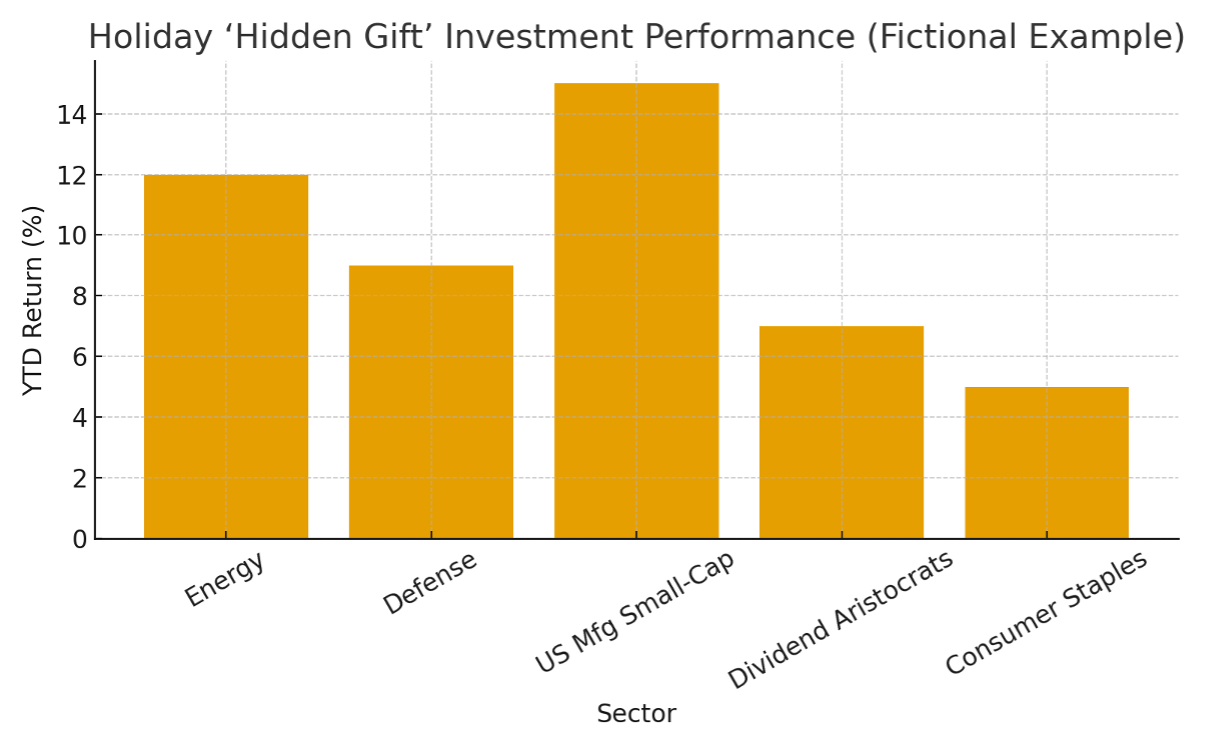

🎁 Santa’s Hidden Investment Gifts

• Energy: Still powering the sleigh. Stable demand, strong cash flow, and pricing that refuses to melt like a snowman in Phoenix.

• Defense: As global tensions stay as spicy as eggnog with extra nutmeg, defense plays continue to shine — not flashy, just dependable.

• U.S. Small‑Cap Manufacturing: Santa’s favorite. Quiet, overlooked, and humming like the North Pole workshop. A true under‑the‑tree surprise.

• Dividend Aristocrats: The gift that keeps on giving. Reliable payout increases even when markets get frosty.

• Consumer Staples: Because naughty or nice, everyone still buys soap, snacks, and tissues for holiday movie tears.

📊 Hidden Gift Performance Chart

Here’s Santa’s fictional look at how these hidden gifts performed heading into the holiday season: